What is Trial Balance , methods and advantages of TRIAL BALANCE?

TRIAL BALANCE :

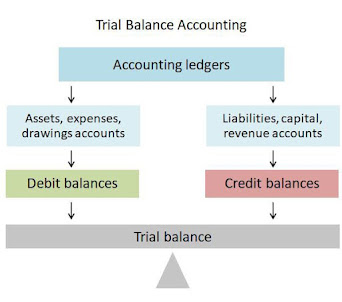

Trial balance is the statement of debit and credit balances extracted from the ledger , with a view to testing the arithmetical accuracy of the books.

In the process , after recording and classifying of business transaction summary of transactions is to be prepared. Trial balance is the first step in the direction .Trial balance is a statement or list in which balances of all the accounts including cash and bank are shown.

Illustration: Let’s say we buy a jeans for say Rs. 1000 on credit. Now we receive the jeans and have to pay money. So this transaction has two activities.

- Buying the jeans

- Taking credit from seller

Purchase A/c | Dr | 1000 | |

| To Creditor A/c | 1000 |

| Debit ( Rs ) | Credit ( Rs ) | |

Purchase A/c. | 1000 | – |

| Creditor A/C. | – | 1000 |

METHODS OF PREPARING TRAIL BALANCE :

The following three methods are discuss :

1.TOTAL METHOD: Under this method , trial balance is prepared by taking up the total of both debits and credits of all accounts in the ledger.This method saves time, as the time taken to balance the account is saved and the trial balance can be prepared as and when the accounts are totaled. However, this method is not used in general, because it does not help in the preparation of the final accounts.

2.BALANCE METHOD:Under this method, trial balance is prepared by taking up balance of each ledger account only.Balancing of ledger account implies tallying both the debit and credit sides of the particular account by placing the balance on the side where the amount falls short.

3.COMPOUND METHOD:In this total and balances , both are shown in the trial balance. The statement contains columns for both totals as well as balances.

Objectives of Preparing Trial Balance:

- To ensure arithmetical accuracy of the books of accounts, which indicates that the books are free from any mathematical errors and both the aspects of the account are recorded, in journal and ledger.

- To prepare financial statement, as trial balance forms a base for preparing final accounts at the end of the financial year.

- To act as a summary of the ledger, as it compiles the balances of all accounts.

Trial Balance prepared to verify as to whether the totals of the debit column equals the total of credit columns.

1.JOURNAL

2.LEDGER

3.TRAIL BALANCE

Comments

Post a Comment